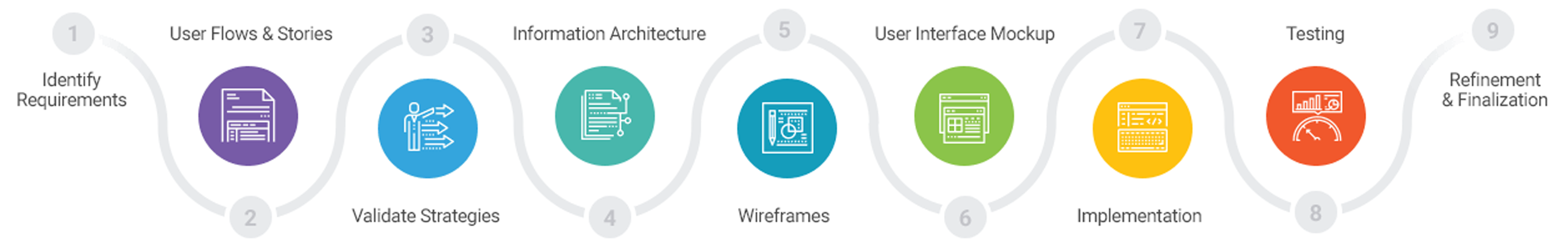

Step 1

Identify Requirements

International savings accounts or a certificate of deposit (CD) can provide access to higher interest rates than is offered in your home country. Due to differing foreign banking requirements—some which have a residency requirement—it can take enormous amounts of time to sift through actionable options to find an optimal position. Goals for this data science application include drastically reducing the cognitive load and time-to-decision, while greatly increasing the rate of a position's success through risk hedging and real-time reporting strategies.

Use Case Background

1. An international savings account is not an offshore account.

2. Countries with higher interest rates may be prone to a rapidly devaluing currency due to inflation or worse—default risk due to unrest.

3. The FDIC in the US will only insure domestic deposits, so it’s worth noting countries that offer deposit insurance when modeling default risk.

4. Exchange rates and fees, bank maintenance fees and minimum deposit requirements are necessary relative return rate factors.

As Product Owner, I defined each of the technical requirements for the application, ranging from MVC website framework, to data science tools, to front-end charting libraries. I also developed a user story map prior to switching hats to address the technical back-end, user interface and user experience.

Step 2

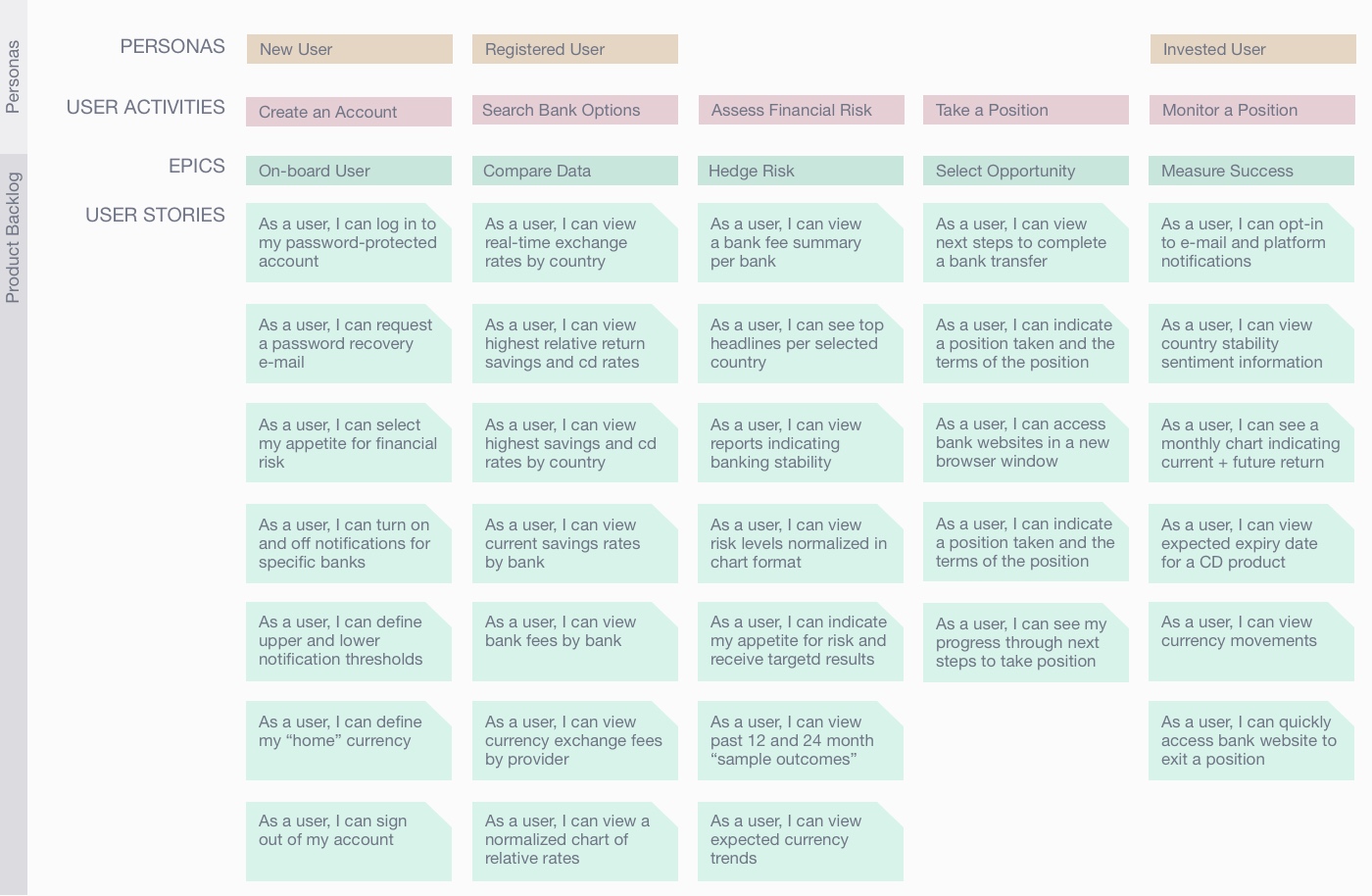

User Flows & Stories

As Product Owner, I created epics and user stories that capture the main product functionality from the perspective of the end-user. This helps articulate different user personas, what tasks each wishes to accomplish with real-time data, and why.

Step 3

Validate Strategies

Step 4

Information Architecture

Mapping out the application via detailed wireframes and user-flows allowed for effectively designing a frictionless user journey.